3D audio animation, variable size and support, 4"54, 2018.

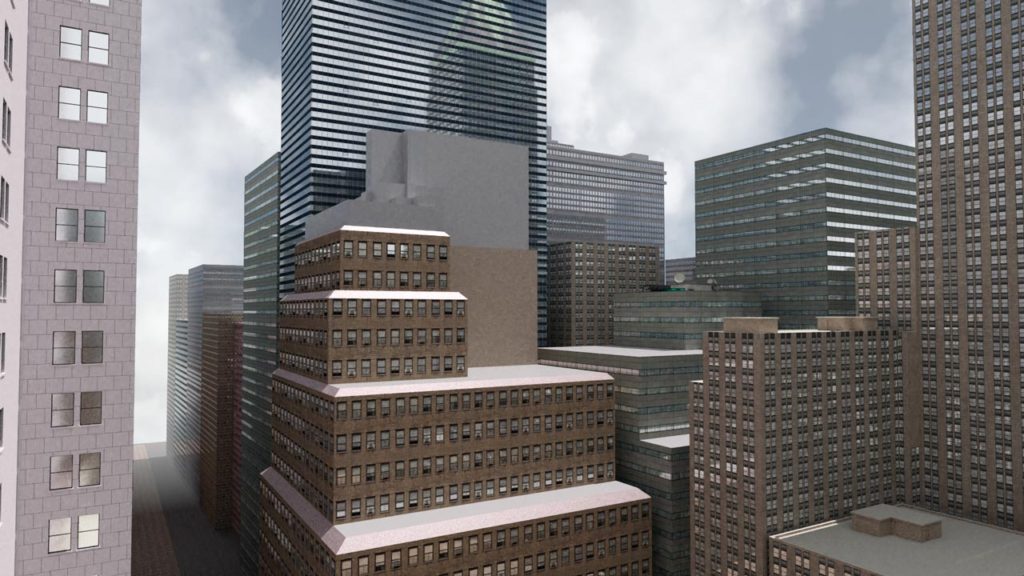

This project takes as its starting point a detail of the 2007-2009 crisis commonly referred to as the subprime crisis. It concerns the implementation of capital controls by the Icelandic government from 2008 to 2017 which prevented foreigners holding Icelandic krona from selling them. One currency, one territory. The New York Stock Exchange, an emblematic building of the market economy, was modelled end-to-end in 3D. The virtual stroll that is proposed here was built in an analogy with the trading systems of world markets.

Between A and B, a purchase order, a camera moves, it passes the controls, the identity and authenticity of A and B must be verified, orders are issued by electrical way between different components of a system and are reflected on the others. Between servers, mobile terminals, from underwater cables to LED screen. This animation shows a pause in this frenzy, it shows a power grab, the architecture here becomes a symbol of the different forces at work in the economy.